We have all been adapting to a virtual environment in 2020, and hosting our 2nd annual Fireside Chat series (virtually) was no exception! In the last week leading up to the election, Sterling hosted three separate invitation-only 45-minute chats to address the questions on the forefront of most investors’ minds: the election, COVID, and what’s to come. These chats were inspired by our desire to help you gain insight, knowledge, and perspective around how the current economic and political environment could impact your investment strategy and overall wealth planning objectives.

We were fortunate to be joined by representatives from two of the firms that we partner with to help protect and grow our clients’ investment capital: Tim Duffy from PGIM Investments and Matt Moslander from JP Morgan Asset Management, who were in attendance to provide their perspectives on our main topics.

Please be mindful that our intention was to present solely about facts, and not in any way give an opinion one way or another about where Sterling or us as your advisors stand politically. We focused on data-driven outcomes and statistics, not politics.

Below you’ll find the key questions and takeaways from Sterling and our investment partners. We hope that you find this dialogue serves as a helpful reminder to keeping emotions at bay when it comes to your investing goals, even when it’s easier said than done.

It is our privilege and honor to serve you and your families each and every day. Thank you, from all of us on the Sterling team, for your continued confidence in us as trusted advisors, fiduciaries, and advocates.

Sincerely,

Steve, Megan, Luke, and the Sterling Team

The 2020 Election

What impact can the 2020 election have on the economy and our investment portfolios?

- Key takeaway: Elections provide certainty. That’s what markets want. There will likely be volatility in the short-term before markets know the results of the election, but once there is certainty in a winner, volatility should subside.

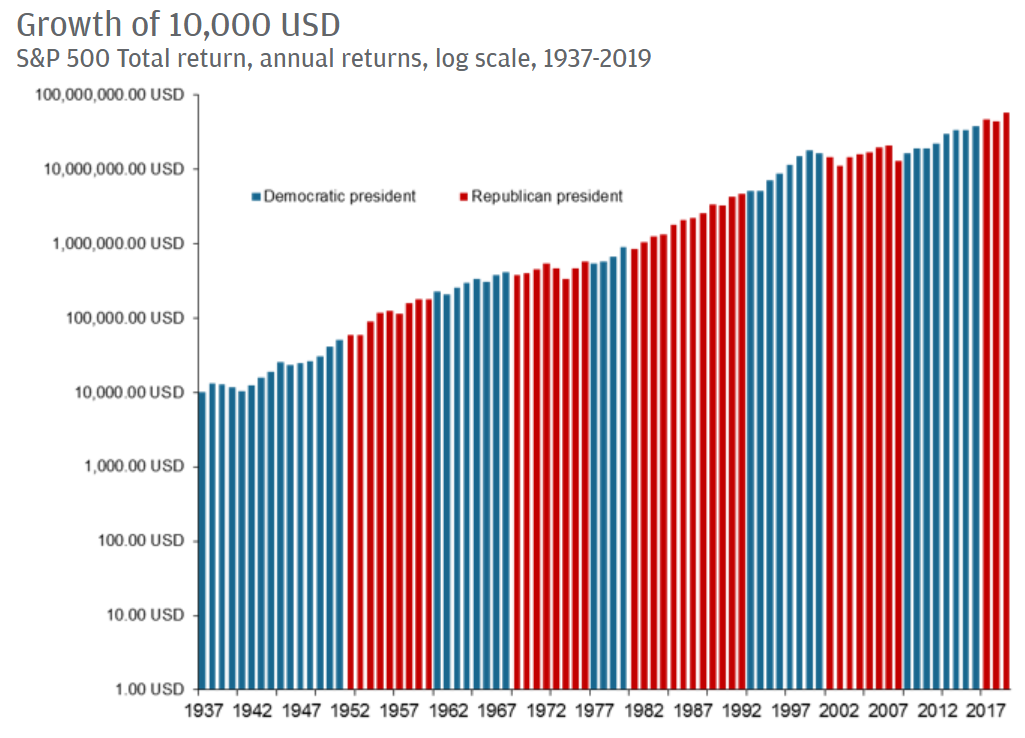

- Growth has occurred over presidents of each party. S&P Slide image.

- Since 1970, on average, the elected president has been able to implement just 8% of their original campaign agenda into law. Checks and balances within the three branches of government prevent huge policy swings no matter who’s in office.

(Source: JP Morgan Asset Management)

(Source: JP Morgan Asset Management)

What moves does Sterling see with either a Biden or Trump presidential win?

- Key takeaway: We’ve looked at the possible changes in policy from both candidates and could see implementing a few small ‘tilts’ to the portfolios following the election.

- If Trump wins – We are looking at tilting a little more towards companies that should do well from an uptick from slightly higher inflation and greater infrastructure spending, as well as decreased regulation.

- If Biden wins – We’re most likely looking at more stimulus spending, so tilt more towards companies that would benefit from higher stimulus and an increase in regulation.

- The markets (and probably all of us!) are looking forward to the end of the uncertainty.

COVID-19

Looking back at the COVID recession, why was the COVID recession different from others? What can we learn from it?

- Key takeaway: This recession has been driven by a specific event (not to say we’re out of the woods), but there will most likely be a clear end, even though the timing of which is unknown.

- No investment manager was forecasting a global pandemic. Ended up with the quickest contraction into a recession ever, largely due to the economic lockdowns.

- With other recessions, you could typically point towards things that caused it. With this one, there was no bad player. Because of that, there was a quick and large response to the slowdown which, in comparison, was 3x larger than the Federal response to the 2008 recession. This led to the quickest rebound in history (Source: JP Morgan Asset Management).

- Some sectors have been hit hard (leisure, airlines, travel, etc.) while others have been helped (technology).

What was Sterling’s response to the COVID-market decline?

- Key takeaway: We stuck to our core investment strategy of rebalancing. Stuck to our equity and bond targets to make sure they were in line. We were buying stocks at the end of March/April which significantly boosted performance year to date. Since, we’ve had to take money out of stocks a couple of times as the market has recovered.

- We made a couple small tweaks in March/April but no large changes.

- Tilted away from the industries that we thought would have a slower recovery coming out of COVID (travel/leisure). Trimmed exposure to real estate (people working from home hurts commercial real estate). Tilted more on an Asian recovery vs. a European recovery.

- Moved towards larger, higher-quality companies with better cash flow.

What does the consumer look like post-COVID? What are the opportunities?

- Key takeaway: The pandemic didn’t cause changes to consumers – they were already happening. The pandemic simply accelerated the changes.

- While consumer credit/debit transactions declined 37% during the downturn, they’ve almost returned to January 2020 levels (now only at a 4% decline since January).

- Travel/Leisure hit hard, but those are only 20-25% of GDP. Other parts of economy have been not hit as hard, and some areas have had huge growth.

Interest Rates, the Federal Reserve, and Bonds

What does the future of bonds look like? Where will interest rates go? Is it still worthwhile owning bonds?

- Key takeaway: Return assumptions for bonds are lower across the board, but that’s not the primary reason we own bonds. Bonds provide a volatility cushion for the portfolio and were extremely important to own during the crisis earlier this year.

- In March, Fed brought overnight rate to 0%; the first time since the 2008 cycle. More recently, the Fed met in September and announced that they’re not going to raise the interest rate until the end of 2023.

- As such, rates will likely stay low for a long time. Won’t get great yields from them. BUT – that’s not the reason to own bonds. They still play the same role they always have.

International Markets

Investors in the US hear primarily about only US markets. What’s going on overseas? Any opportunities there?

- Key takeaway: It’s incredibly important to stay diversified, and there are good reasons to invest domestically and internationally. Having a broad mix of investments will most likely allow for an effective strategy across market cycles.

- Economic growth goes in cycles. 2000-2010 was a lost decade for US stocks, but international stocks had strong growth. We can’t market time, but we invest all around the globe all of the time.

- Outside of the US, the middle class is seeing a huge emergence out of poverty that will most likely fuel global growth for many years to come.

In closing…

- Focus on data-driven facts versus what you hear in the media. Try to tune out the noise.

- We focus on the integration of investments and planning – investments are just one piece of the overall pathway to financial planning success.

- When we create financial plans, we use conservative returns and stress-test with future recessions and other volatile periods in mind. We’ll go over how the markets impacted your plan during each of our meetings with you.

The views stated in this letter are not necessarily the opinion of Cetera Advisor Networks LLC and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results. Rebalancing may be a taxable event. Before you take any specific action be sure to consult with your tax professional. All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be successful. Additional risks are associated with international investing, such as currency fluctuations, political and economic stability, and differences in accounting standards. A diversified portfolio does not assure a profit or protect against loss in a declining market. Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing. The S&P 500 is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.